How Financial Leverage Explains the Difference Between Roa and Roe.

ROA measures the efficiency of operating management. Discuss how financial leverage explains the difference between ROA and ROE.

Return On Assets Roa And Return On Equity Roe Fundamental Analysis Youtube

Because of financial leverage.

. But if that company takes on economic leverage its ROE would rise above its ROA. While Return on assets is the amount of profit earns from the assets or resources. Solution for explain the difference between ROA and ROE a.

The balance sheets fundamental equation shows how this is. Because the issues of G-Bond. If there is no debt shareholders equity and total assets of the company will be same.

The major factor that separates ROE and ROA is financial leverage ie. The DuPont identity a popular formula for dividing ROE into its core components best explains the relationship between both measures of management effectiveness. Return on assetsROA is a component of return on equityROE both of which can be used to calculate a companys rate of growth.

The net Interest margin for each one is different. This method provides a manner through which financial institutions like banks can compare to each other and how they can monitor their performance during certain periods. Basically the profit divided by equity.

This means that in this scenario ROE and ROA will be equal. While the debt ratio is under 5397 there is a positive relationship that states the debt financing contributes positively to firm value while debt ratio is between 5397- 7048 the positive. There are two different Net incomes for these two ratios.

1ROE is Return on Equity while RNOA is Return on Net Operating Asset. Ever wondered what was behind that dreaded term financial leverage. ROE net income total assets total.

ROE measures the efficiency of capital or financial management. Heres a quick write-up how I see it work. One major difference between ROE and ROA is debt.

While in ROA debt part is added into it which is clearly specified into balance sheet Total Assets Liabilities Shareholders Equity Return on equitys concern much more on the capital or. Logically their ROE and ROA would also be the same. The difference between the ROE vs ROA is financial leverage in which ROE does not involve any kind of debt.

Return on Assets ROA can be obtained by dividing the total net income by average assets while Return on Equity ROE is found by dividing the net income by equity. By taking on debt a company increases its assets thanks to the cash that total in. Now if the company decides to take a loan ROE would become greater than ROA.

A good part of a businesss net income for the year could be due to financial leverage. The big factor that separates ROE and ROA is financial leverage or debt. Return on assets shows how profitable a companys assets are.

A higher ROE is not always an indicator of an impressive. February 6 2020 February 6 2020 bonny buy essays online After completing the business simulation at a competent level you will work as a team to create a presentation for stockholders and the board of directors for review. Heres how to calculate the return on assets ROA ratio.

Analyze your company s performance for three of the eight years in comparison to one of your competitors on each of the following. Return on equity measures the rate of return on the shareholders equity of common stockholders. Financial over-leveraging means incurring a huge debt by borrowing funds at a lower rate of interest and using the excess funds in high risk investments.

Discuss how financial leverage explains the difference between ROA and ROE. A Include the following graphs in your analysis ROS ROA and ROE Graph Summaries from MBA CAPSTO C216 at Western Governors University. Understand ROE and ROA through the DuPont Identity.

RoERoA RoA-iDebtEquity A bit of explanation to this mumbo jumbo. In the absence of debt shareholder equitableness and the companys total assets will be equal. Please explain the difference between ROA and ROE.

Empirical results reveal that there is a strong triple-threshold effect between financial leverage debt to total assets ratio and firm value. In a nutshell ROE is ROA when adding financial leverage to the mix in a firms capital structure. This is what an investor stock holder or a manager wants to maximise.

April 21 2021. 2The formula for ROE is net income after taxes divided by shareholder equity while the formula for RNOA is net income divided by total assets. Leverage Risk and Misconceptions.

Return on Equity is the one were after. Because the issues of G-Bond c. Discuss how financial leverage explains the difference between ROA and ROE2.

Net operating assets represent the total amount. The net Interest margin for each one is different. Debt is included in ROA which can be clearly seen in the balance sheetTotal Assets Liabilities Shareholders Equity 3.

If the risk of the investment outweighs the expected return the value of a companys equity could decrease as stockholders believe it to be too risky. Stock price Dividends Earnings per share Bond rating if. EBIT Net operating assets ROA This equation uses net operating assets which equals total assets less the non-interest-bearing operating liabilities of the business.

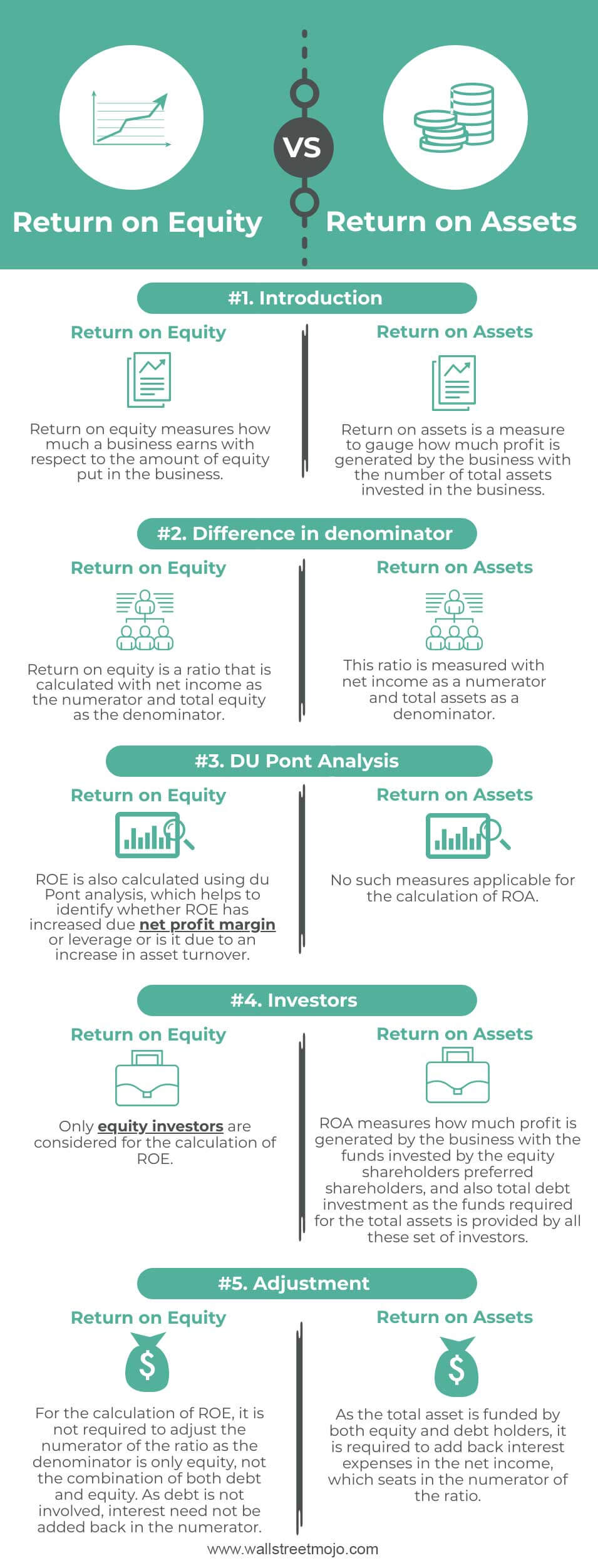

Roe Vs Roa Top 5 Differences With Infographics

Roe Vs Roa Top 7 Differences To Learn With Infographics

Dupont Identity Of Return On Equity Roe This Breaks Roe Into Profit Margin Total Asset Turnove Return On Equity Accounting And Finance Financial Management

No comments for "How Financial Leverage Explains the Difference Between Roa and Roe."

Post a Comment